SALESDRIVETM

Accelerating towards sales transformation with Salesdrive

PRODUCT

Overview

While most businesses relied heavily on face to face meetings and interaction, there has been a perceptible shift. The new normal has empowered customers to make demands. Salesdrive, a sales transformation tool from iorta offers streamlined processes, seamless journeys, optimised cost and increased efficiency.

Salesdrive is a unified solution that will transform the entire distribution channels and offer enhanced customer experience. The lego-like build offers effortless sales automation across the entire sales lifecycle journey from pre-sales, the actual sales process to post sales.

McKinsey study has shown “Automation can reduce the cost of a customer journey by as much 30%”.

PRODUCT

Highlights

Native Experience Across All Devices

The solution works seamlessly across web browser, mobile and other handheld devices with accessibility from anywhere and any time.

Action-Oriented User Interface

Real-time dashboard with updates across the purchase journey for tracking lead progress and employee performance.

Unified Lead Management

Lead assignment/reassignment and complete overview for Managers, agents and customers. Subsequently offering upselling and cross-selling opportunities.

Customisation Of Systems

Create complex structures, customise access to the dashboard, activate internal and external sales teams within minutes with full control over the entire system.

Synchronised Pos Push Across Enterprise

Integrated with core systems, Salesdrive offers businesses integration solutions to ensure seamless data synchronization across the enterprise.

Assisted Buying

Customers have the option of self-service and assisted by an expert option helping them take informed decisions and live- screen supported sales fulfillment

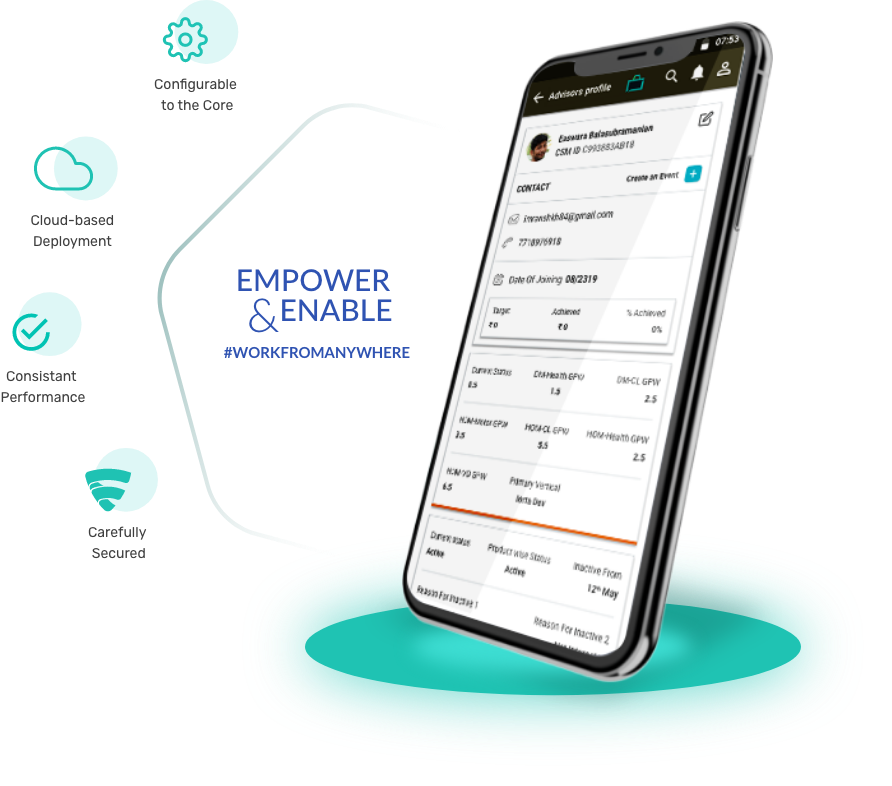

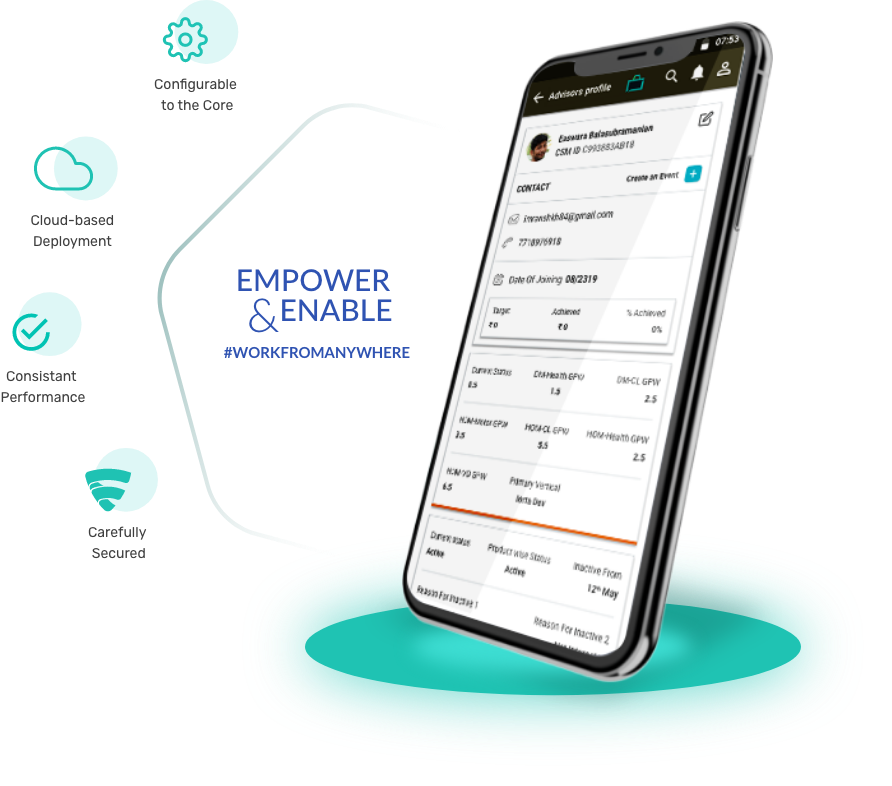

WHATS NEW?

Stay Home Stay Safe

SalesDrive’s modules are low-dependency Lego-like blocks which can fit in your existing sales process like a glove. Coupled with enterprise-friendly principles like dedicated instances for extreme customisation, extensibility using RESTful APIs, and cross-platform front-end framework, Salesdrive removes headaches from transformation processes.

SalesDrive works with any video conferencing solution for remote selling (Centrally upload presentation and content for control & consistency); the inbuilt dashboard offers customer and agent onboarding workflow & updates; automatic predictive dialing and call allocation for higher productivity while working from home; and easy access to lead / customer related data at any point of time, can be accessed from anywhere and on any device.

THE BLOCKS

Overcoming challenges with Salesdrive

Salesdrive’s modules are low-dependency individual blocks

that

fit into your existing sales process with ease.

Lead Management

Create leads, allocate it to sales team members on the go, check their updates, track the history of activities on the lead and receive day-end reports

Campaign Management

Define sources for leads and opportunities, track and compare the periodic volume, connection and conversion ratio, without needing a spreadsheet

Customer On-boarding

Onboard customers quickly, effectively, and peerlessly via Salesdrive’s easy to use functionalities like proposal fulfillment, point-of-sale, document upload and quality checks.

The definitive customer management software you can relay on.

Agent On-boarding

Show candidates business opportunity presentations, success stories, and capture education, employment history details with document and a customised personality test

Live Dashboard

Our action-oriented live dashboard gives you comprehensive, 24/7 into your company’s sales funnel, displaying essential glanceable information and enable you to navigate to the required module quickly.

Rewards and Recognition

Drive your channel’s end-of-the-month numbers with sales contests and communicate contests’ targets and rewards to the last-like user without wasting precious time

Servicing

Don’t direct your esteemed customers to a branch or call center, but help them capture service requests right from Salesdrive. Works for members self- service as well

Sales Pitch

Show your prospects presentations, testimonials videos and with a specialized recommendation engine suggesting plans tailor made as per customers profile. All of this from a single place

FAQ’S

Have Questions?

LETS CONNECT

We can help transform your business

& make it future-ready